Health Plans & Prices - Saint Louis MO (2018)

2018 Health Insurance Open Enrollment runs November 1 - December 15.

Open Enrollment is the only time of year most people can enroll in or change their health plan. When you enroll during this time period (Nov 1 - Dec 15), your effective date for your new plan will be January 1st, 2018. If you try to enroll after December 15, you will be denied, unless you lose employer coverage or have another similar life event.

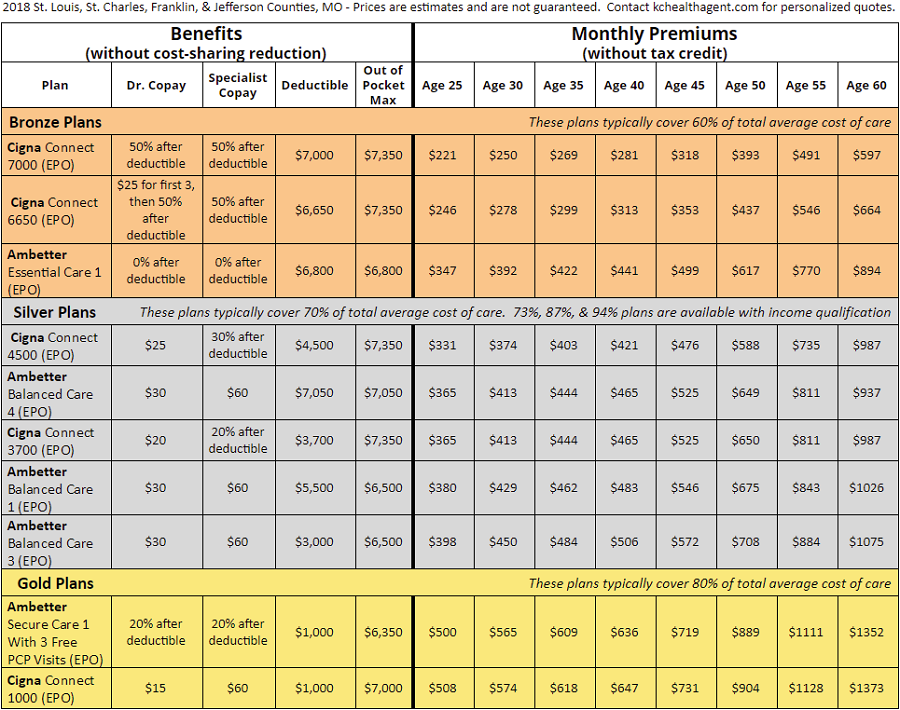

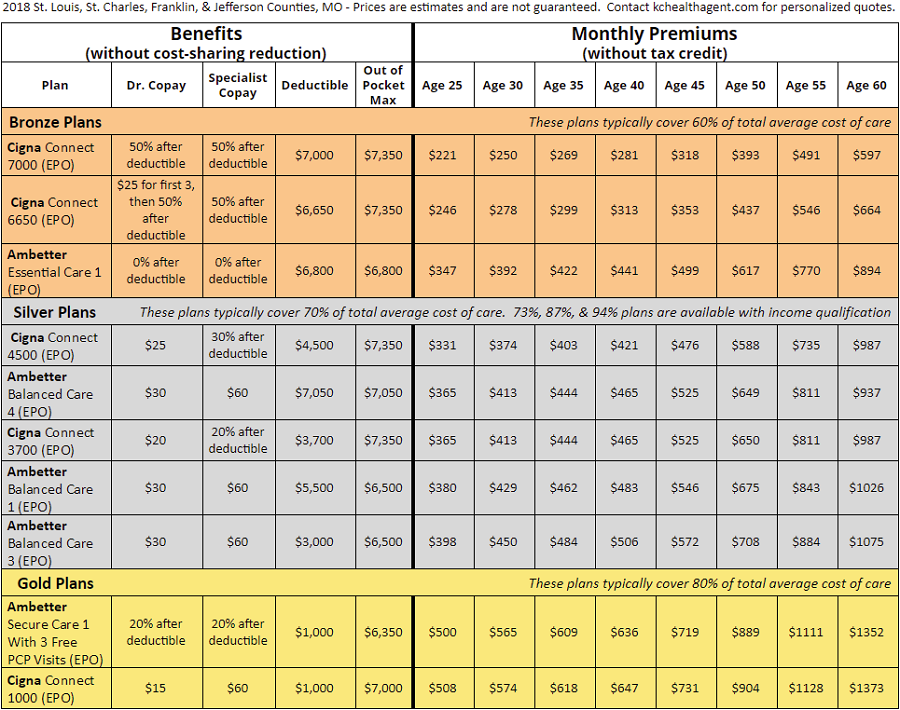

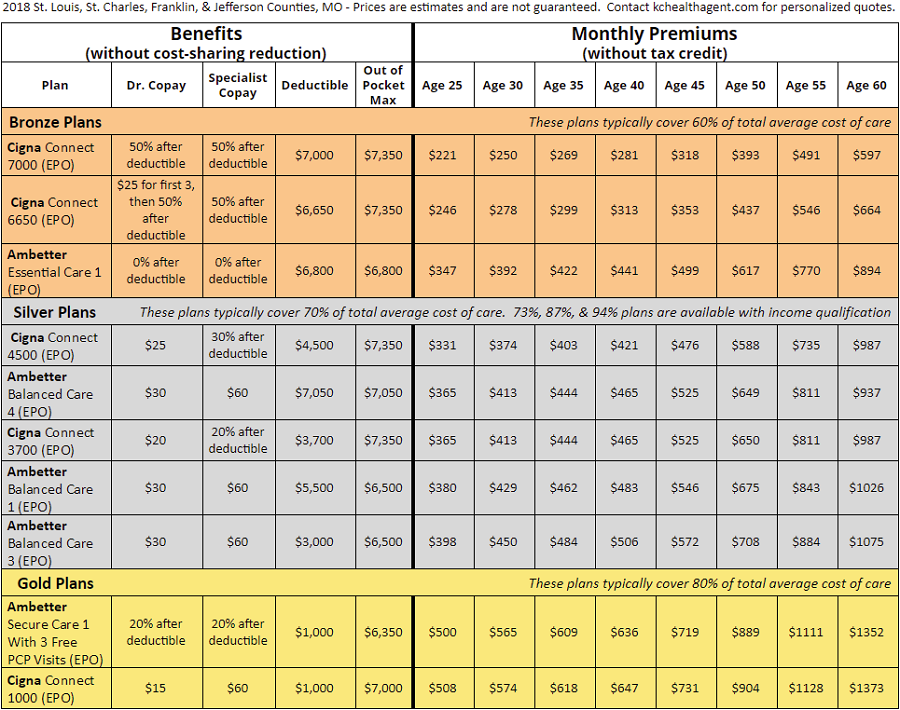

If you need specialist visits covered, you will likely need to choose a Silver Plan.

Bronze Plans rarely cover specialist visits before your deductible. Many Silver plans cover specialist visits in form of a "Copay" that is paid by the member. Most Gold plans cover specialist visits, usually at a lower copay than the Silver plans (unless you qualify for Cost Sharing Reduction). Specialist copays are generally anywhere from $40 /visit - $80 /visit, depending on the plan.

In St. Louis - Two companies are offering individual coverage.

Ambetter is new in Saint Louis for 2018, while Cigna is also offering plans.

Much of Missouri only has one company offering health insurance.

For some areas, this is serviced with Ambetter Health. Other areas are serviced by Anthem BlueCross BlueShield (not to be confused with BCBS of KC). Springfield, Missouri is covered by Ambetter, which covers Mercy Hospital, but does not cover Cox Health Systems. Saint Louis and Kansas City both have Ambetter and Cigna.

EPO's, HMO's, PPO's are different types of networks.

This is important to know.

EPO's and HMO's do not cover any doctor or hospital outside of the network. This means that if you go to the wrong hospital, you will have to pay the entire bill and will not be covered. On the other hand, PPO's allow you to go outside of the network and be covered, but usually with a higher deductible. PPO's don't require a referral from your primary doctor to see a specialist. HMO's nearly always require a referral from your Primary Doctor. EPO's sometimes require a referral.

EPO stands for Exclusive Provider Organization.

HMO stands for Health Maintenance Organization.

PPO stands for Preferred Provider Organization.

Preventative care is covered at 100% without needing to meet the deductible.

Blood Pressure Screening, cholesterol screening, colorectal cancer screening (over age 50 only), depression screening, type 2 diabetes screening, Immunization vaccines, and more are covered for all adults.

Women are also covered for Anemia screenings, breastfeeding support and counseling, contraception (birth control), folic acid supplements, urinary tract infection screening, breast cancer genetic test counseling, breast cancer mammography screening, cervical cancer screening, well-woman visits, among others.

Dental coverage is not included in health insurance plans.

With the exception of checkups for children under 18 in some cases, dental is typically not included and must be purchased separately. CIGNA has no waiting period in Missouri for its dental plans. Most of the plans make you wait 6 months - 1 year before being covered for cavities and other dental work. Dental plans can be purchased year-round outside of the health insurance marketplace.